- Porter's 5 forces - Summary

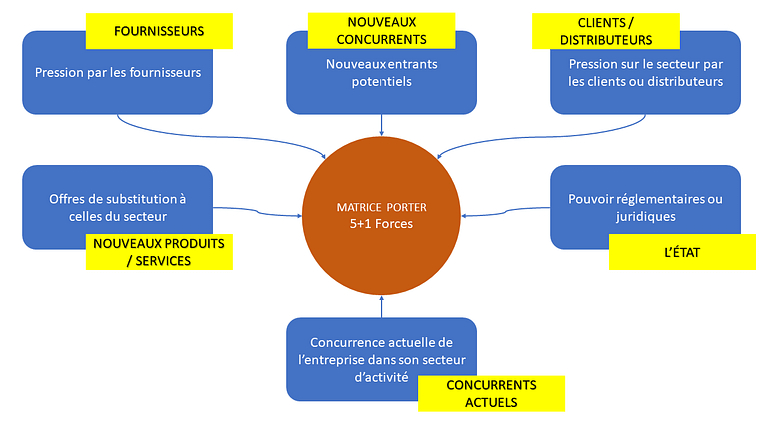

Porter’s 5 Forces is a tool that allows you to perform a competitive analysis of a market. It is based on the following 5 axes: the intensity of competition, the bargaining power of customers, the bargaining power of suppliers, the threat of new entrants and the threat of substitute products.

Mickael Porter defined this method of market analysis in the 1980s and the 5 components that make it up are all the factors that characterize any market. Porter’s 5 forces matrix allows its users to develop a strategy in a market where competition is strong. It takes into account suppliers, customers, substitute products, current competitors and potential competitors.

The regulatory and legal dimension was not taken into account by Michael Porter, he was even opposed to it. However, as this dimension can be a source of constraint for the company, it is interesting to add it.

Here I explain what Porter’s 5 forces method is and how to use it.

The bargaining power of suppliers in Porter’s 5 forces

This is the bargaining power that suppliers can exercise over the company. Can suppliers impose their conditions in negotiations? The power of suppliers can impact prices, and therefore the profitability of the company.

Some examples of what to evaluate at this level:

- the degree of scarcity of products/services sold by suppliers;

- the number and size of suppliers;

- the cost of switching suppliers.

When there are few suppliers and they have a large number of customers, they will have more power to impose their terms on the market. On the other hand, if there are many suppliers, the company can easily switch from one to another, and it has a greater capacity to negotiate.

The threat of potential new entrants

In Porter’s 5 forces, it refers to firms that could enter the market and threaten existing players. The level of threat depends on how difficult it is for new entrants to enter the market. The more barriers to entry there are, the more difficult it will be for new entrants and the lower the threat. These barriers can be characterized by:

the efforts or the amount of investment to be made to launch and get customers;

the lack of image or notoriety in this market;

the capital requirements necessary to enter the market (advertising, R&D investment, etc.);

the ability to access distribution channels;

the critical size to be reached to be profitable;

the regulatory level to be able to exercise the activity (diplomas, authorization from the administration, licenses, approvals…);

…

The bargaining power of customers

Here we are dealing with the bargaining power that customers can exercise over the company, i.e. the customer’s ability to negotiate the price, the associated services, the level of quality, etc. This impacts the profitability of a company. A customer is considered to have this power when:

- it buys large quantities of products/services from the company;

- many competitors are available for this type of product;

- he has the objective to reduce his purchasing costs;

- he can put pressure through negotiations.

The threat of substitute products

It is made up of new products or services likely to enter the market and which can be an alternative to the existing offer. These are most often innovative products that bring more value than what is currently offered on the market.

We need to ask about:

- the transfer costs (low it will be easier for the customer to change);

- the price/performance ratio is the same or lower;

- the advantages and disadvantages of the alternative products;

- the communication that is done on these products (if it is aggressive, it will have a stronger impact).

Customers will be more likely to buy a substitute product that has a higher added value. Faced with this type of threat, the company must develop its offerings and products to bring more value to customers.

Apple case:

When Apple entered the cell phone market, its model was very innovative and it was able to adapt the market to its advantage.

Competitive rivalry

It affects the company’s profit: lowering prices, launching new products or intensive communication. This rivalry can have an impact if:

- there are many competitors;

- the proposed offers are identical (degree of differentiation of competitors);

- market growth remains low;

- fixed costs are high;

High competition often results in a price battle, which can negatively impact the company’s margins. Achieving profitability will be more difficult. To do so, the company must have a large volume of business. And if competitors are large, their cost dominance can be strong and difficult to overcome.

Regulatory and legal authority

It can be important especially when:

- products or services must meet environmental standards or constraints;

- patents must be respected;

For example, the General Data Protection Regulation (GDPR) imposed by the European Parliament has strongly impacted GAFAM (Google, Amazon, Facebook, Apple and Microsoft) but also many companies whose activity is the resale of personal data.

- Why use this tool?

Porter’s 5 forces are an interesting tool for any company considering entering a market. This can be a business start-up or the launch of a new product or service.

For an existing company, Porter’s matrix can be used to conduct strategic intelligence, particularly because all companies operate in environments that are constantly changing. The company must detect new opportunities and anticipate potential threats to its business. It must do this in its micro-environment (its market, with the Porter matrix presented here) but it must not neglect the macro-environment either (using PESTEL). Concerning the market, one must monitor for example:

the arrival of new competitors;

the launch of a product that constitutes an alternative to the current offer;

the decrease in the number of key suppliers;

changes in regulations (environment, patents, safety, price control, etc.)

the weight of distributors;

…

This market analysis provides the company with essential information to make the right strategic decisions.

- Advice for use

Porter’s 5 forces model is a good tool for assessing your market. But to get the most out of it, it should be adapted in the following ways:

Include government, legislation or regulation in the thinking. We have done this by including a 6th force.

Avoid using the model by focusing on threats only, because in this way, we address less the opportunities and we also exclude any collaboration strategy.

This model should be complemented with the SWOT analysis for better decision making.

If the bargaining power of your customers is important, innovation is the key to maintain a higher perceived value than your competitors and diversification of the customer portfolio is also a key element to reduce the bargaining power of customers.

To reduce the bargaining power of your suppliers, identify others that you can quickly lean on in the event of a default by your incumbent supplier(s).

If the threat of new entrants is important, erect barriers to entry by, for example, making your brand a reference brand. You can also file patents on your products, etc.

If the threat of substitute products arises, innovate here too to maintain a perceived value superior to that of competitors’ products or services.

If the competitive intensity is too high, form alliances with one or more competitors to gain an upper hand over other competitors.

Public authorities represent a great competitive force, you must anticipate the evolution of legislation or regulations that apply to your activity, use legal loopholes or lobby.

Project manager since 1998, Agile since 2001 then PMO since 2009, I accompany companies in the realization of their projects/programs, in the construction and management of the PMO, in the improvement of processes and I help managers to improve their performance.

Related

Articles non similaires.

You must be logged in to post a comment.